Introduction

This Article considers 3 recent Decisions from the English Courts. The issues within these cases centre around:

- Clarity of a Pay Less Notice;

- An Interim Freezing Injunction to Prevent the Other Party offloading its assets; and

- “Smash and Grab” Adjudication after a “True Value” Decision.

Clarity of a Pay Less Notice

In the case Advance JV and others v Enisca Ltd [2022] EWHC 1152 (TCC), the Claimant (“Advance”) sought declaratory relief pursuant to a Part 8 Claim issued against the Defendant (“Enisca”). In a decision dated 8 February 2022, an Adjudicator decided that Advance did not issue a valid Pay Less Notice against an Interim Application for Payment and consequently, Advance was to pay Enisca the sum of £2,717,922.88 identified as being due in the Application. Advance sought declaratory relief from this decision.

Enisca had issued its Application 24 on 22 October 2021, the gross value of which was £5,131,642.49, an increase of over £1.4 million or almost 40% of the entire gross valuation since the previous month (Application 23). Taking into account the sum paid to date, the net payment applied for was £2,717,922.88 against the previously certified figure of £2,270,597.38. Unfortunately, no Payment Certificate was provided by Advance to Enisca in respect of Application 24.

On 19 November 2021, Enisca submitted its Application 25, the gross value of which was £5,217,303.71, an increase of just £85,661.00 compared to Application 24.

Advance issued a Payment Certificate on 25 November 2021 in response to Enisca’s Application 25. Advance’s assessment resulted in a negative payment value, to which Advance adjusted the figures “to show a Zero payment to prevent any credit notes needing to be made”. Although specified as being related to Application 25, the Payment Certificate had been issued one day before the expiry of the time window for provision of a Pay Less Notice in respect of Application 24.

Advance claimed that the Pay Less Notice, issued with the Payment Certificate, in response to Application 25, indicated to a reasonable recipient that Advance did not intend to make any further payment in respect of either Application 24 or Application 25 and therefore was a timeously served Pay Less Notice against Application 24.

Enisca argued that the Pay Less Notice was in response specifically to Application 25 and that no valid Payment Certificate or Pay Less Notice had been issued against Application 24.

The Courts held that to qualify as a valid Notice, any Payment Notice must comply with the statutory requirements in “substance and form”. Payment Notices and Pay Less Notices must clearly set out the sum which is due and/or to be deducted and the basis on which the sum is calculated. It was considered that if Advance’s Pay Less Notice was intended to remedy the failure to serve a Payment Certificate in relation to Application 24, it did not make that clear.

Advance’s Part 8 Claim was dismissed and the Adjudicator’s decision enforced.

Conclusion

Advance had intended to issue a Pay Less Notice against Application 25, with the effect of covering its requirement to issue a Pay Less Notice against Application 24 also. Unfortunately for Advance, even though it was apparent that it did not intend to pay any further sums, it was not clear that the Pay Less Notice was against Application 24. It was considered by both an Adjudicator and the Courts that Advance had not issued a valid Pay Less Notice against Application 24 and in the absence of a Payment Notice, Advance was required to pay the sum identified in the Application. In this case it had to pay out a sum of £2,717,922.88, when its intention was to pay a zero sum.

This case highlights the importance of not only issuing Notices on time but also the potential consequences should the intention of a Notice be unclear. A failure in either of these may lead to significant sums having to be paid out.

Interim Freezing Injunction to Prevent the Other Party Offloading its Assets

In the case Nicholas James Care Homes Ltd v Liberty Homes (Kent) Ltd [2022] EWHC 1203 (TCC), Nicholas James Care Homes Ltd (“NHCH”) was a developer who engaged Liberty Homes (Kent) Ltd (“Liberty”) as the Contractor on a number of projects.

A dispute arose over the value considered due to Liberty over the projects, initially on 18 June 2020, with NJCH indicating that it had made overpayments to Liberty across a number of projects, estimated in the region of £1.49 million. Disagreement over sums due to Liberty continued, and on 14 July 2021, Liberty set out its case in a pre-action letter, claiming it was due outstanding sums in the total of £1,151,082. NJCH responded to the Claim in a letter dated 20 August 2021, asserting an entitlement to recover overpayments in the sum of £2,642,587.85.

On 21 October 2021, NJCH pursued a “true value” Adjudication, seeking repayment of sums to the value of £2,387,005 together with interest. Subsequently, on 18 February 2022, the Adjudicator found that NJCH had overpaid sums to the value of £2,589,737.76. Liberty was ordered to repay NJCH the balance of £2,589,737.76, together with interest and the adjudicator’s fees.

Liberty failed to pay the sums awarded by the Adjudicator, and on 29 March 2022, NJCH issued Part 7 Proceedings for an Adjudication Enforcement. The hearing of the Adjudication Enforcement was then listed for 15 June 2022.

During the period of its dispute with NJCH, Liberty had established a number of new corporate entities and transferred assets to them, totalling near £6 million, equating to a substantial portion of the assets identified in its accounts.

The transferring of assets raised concern that Liberty would not be in a position to repay sums owed to NJCH arising from the enforcement hearing. This led to NJCH, on 21 April 2022, obtaining a Freezing Injunction without notice, until after the return date or further Order of the Court.

On the return date, NJCH submitted that Liberty’s October 2020 audited accounts, recorded stocks of £5,764,597.00 and total assets (less current liabilities) of £4,628,413.00, whilst in its 2021 unaudited accounts, Liberty had stocks of £150,000.00 and net liabilities of £201,535.00. It was also ascertained that at the return date, Liberty had no assets in excess of £10,000.00. NJCH insisted that this showed Liberty had taken, and would continue to take, steps to dissipate its assets thus preventing payment of sums that it may be found to owe in the Enforcement hearing.

Liberty submitted that NJCH “inordinately” delayed the application for the Freezing Order, long after the dispute arose, in or around mid-2020. Liberty claimed that there was no evidence of dissipation of assets and that the transfers were part of a corporate restructure, with the assets being validly transferred to other corporate entities. It was argued that the Freezing Injunction, if continued, would provide no relevant utility and would be oppressive by unwinding a legitimate corporate restructuring process.

Pursuant to Section 37 of the Senior Courts Act 1981,the courts must satisfy that it is “just and convenient” to grant a freezing injunction. The test applied by the Courts is summarised in Broad Idea International Limited v Convoy Collateral Ltd [2021] UKPC 24 by Lord Leggatt at [101], to which it must be established that:

- The Applicant has already been granted or has a good arguable case for being granted a Judgment or Order for the payment of a sum of money that is or will be enforceable through the process of the Court;

- The Respondent holds assets (or… is liable to take steps other than in the ordinary course of business which will reduce the value of assets) against which such a Judgment could be enforced; and

- There is a real risk that, unless the Injunction is granted, the Respondent will deal with such assets (or take steps which make them less valuable) other than in the ordinary course of business with the result that the availability or value of those assets is impaired and the Judgment is left unsatisfied.

The Courts held that NJCH had a good arguable case for the Freezing Injunction until the Enforcement Hearing, as it had the benefit of a “true value” Adjudication decision in its favour.

It was held that Liberty was aware of the substantial sums claimed as overpayments by NJCH at the time that the “corporate restructure” was being considered and Liberty maintaining a beneficial interest in the assets was a manner other than in the ordinary course of business.

In relation to the proposition as to whether “there is a real risk”, it was held that Liberty divesting itself of a substantial value of assets posed a very real risk that it would be unable to satisfy any Judgment against it.

Conclusion

This case shows some of the potential issues that can arise when trying to recoup sums considered due. In this particular case, NJCH had made substantial overpayments across a number of projects. Whilst it had received a favourable “true value” Adjudication decision, the other party simply failed to pay the required sums and an Enforcement Hearing was sought.

Liberty had transferred a substantial portion of its assets to related third-party corporate entities, significantly dissipating the value of its assets. Fortunately, NJCH was able to evidence that the dissipation of Liberty’s assets posed a real risk of Liberty being unable to satisfy any Judgment against it. The case also highlights the importance of understanding the other party’s financial position when a dispute arises.

“Smash and grab” Adjudication after a “True value” Decision

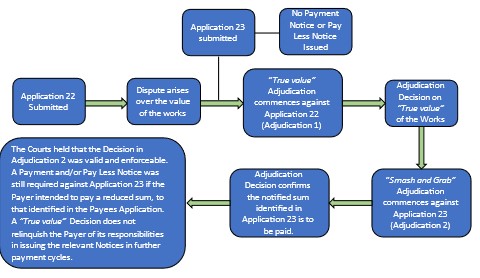

In the case BexHeat Ltd v Essex Services Group Ltd [2022] EWHC 2972 (TCC), BexHeat Ltd (“BHL”) made an application for a Summary Judgement to enforce an Adjudication decision dated 12 November 2021 (“the Second Adjudication Decision”). The Second Adjudication Decision related to a “smash and grab” Adjudication, where it was decided that Essex Services Group Ltd (“ESG”) had not issued a Pay Less Notice in time and was ultimately required to pay the notified sum identified in the Application for Payment.

Prior to the Second Adjudication, BHL had sought an Adjudication decision on the “true value” of its Application 22 (“the First Adjudication Decision”).

On 17 August 2021 (one day before commencement of the First Adjudication), BHL issued its Application 23. Subsequently, ESG failed to issue its Pay Less Notice in time, leading to BHL commencing the Second Adjudication, seeking payment of the notified sum. The Second Adjudication Decision found that ESG had not provided a timely Pay Less Notice and that it was required to pay the notified sum in Application 23.

ESG did not make any payment in respect of the Second Adjudication award, leading BHL to issue proceedings on 23 November 2021, claiming the sum due in Application 23 plus interest, statutory compensation and the Adjudication fees.

ESG argued that it was entitled to rely on and enforce the “true value” from the First Adjudication Decision, despite this being against the previous Application 22.

The courts held that although the First Adjudication commenced prior to the date which a Pay Less Notice was due against Application 23, the First Adjudication was limited to the “true value” of the Works in respect of Application 22 and, even though the “true value” of BHL’s works in relation to Application 23 may have remained the same, the relevant period for valuation was different and required the appropriate Notices from ESG.

ESG’s Application for a Stay of Execution was refused by the Courts, on the basis that the Second Adjudication Decision was valid and enforceable. BHL was therefore entitled to Summary Judgement to the sum identified in Application 23, plus interest and costs.

The diagram below shows the events that led up to the Courts decision:

Conclusion

A “true value” Adjudication decision is often considered to trump payment disputes. This case, however, is a reminder that whilst the sums identified in the “true value” identify the value of the works at that given point in time, submission of further Applications for Payment require assessment on their individual merit and still require the relevant Notices to be issued.

In this particular case, a “true value” decision had been made, but ESG’s failure to issue a Pay Less Notice in time meant it was required to pay the notified sum identified in a subsequent Application for Payment.

This is yet another reminder of just how common place payment disputes are and the importance of issuing the relevant Payment Notices

-

Sheffield

The Annexe,

260 Ecclesall Road South,

Ecclesall,

Sheffield,

S11 9PSTel - 0114 230 1329

-

London

Adam House,

7-10 Adam Street,

London,

WC2N 6AATel – 020 7520 9295

-

Leeds

Suite 69,

4100 Park Approach,

Thorpe Park,

Leeds,

LS15 8GBTel - 0113 397 0358

-

Warrington

Suite 41,

Lakeview 600,

Lakeside Drive,

Centre Park Square,

Warrington,

WA1 1RWTel - 01925 984705

-

Manchester

3 Hardman Street,

Manchester,

M3 3HFTel - 0114 230 1329

-

Birmingham

Birmingham Business Park,

4200 Waterside Centre,

Solihull Parkway,

Birmingham,

B37 7YNTel - 0121 481 2381

-

Liverpool

Horton House,

Exchange Flags,

Liverpool,

L2 3PFTel - 07753 837149